Indicators of Business Staying Power | How Can Future Business Success or Failure Be Forecasted?

- SHAHRUKH SHAFQAT

- Jun 16, 2021

- 12 min read

Updated: Jul 17, 2021

What model can be used to assess business risk and health thoroughly?

©Risk Concern. All Rights Reserved.

Whether investing in a company, assessing a company's creditworthiness, or evaluating your personal business's health, one needs a sound understanding of some important parameters to identify weaknesses or strengths in a business.

This report presents the model based on the most important indicators of business staying power and survivability, that can be used to assess the health of the business under scrutiny, to evaluate whether the business would survive, prosper, face significant hardship, or fail in the future.

To a certain limited degree, the methodology used in this report utilizes the method of Moody's credit rating analysis.; a method that is trusted by large financial institutions, etcetera. Moody's methods of assessment have refined over the years, nonetheless, this report uses a further modified version of their methodology for a more accurate assessment of business health and staying power. Fundamentally, the tools provided in this work are useful for analyzing risk associated with a subject business.

The model allocates a probability of success, or failure, primarily

So, how do we analyze risk to determine the staying power of a business

The broader areas that we must examine are the following:

1. Business sensitivity

2. Profile and market position

3. Leverage and Liabilities and financial strength

4. Idiosyncratic risks

Business sensitivity relates to the company's strength to deal with adverse events. For example, the firm's ability to handle a recession or negative economic climate, its power over suppliers, supplier's business health, the strength of its supply chain, etcetera, and its broader purchasing power. Access to the capital and debt markets would also be assessed under business sensitivity. The same factors in relation to the companies buyers also must be evaluated.

Profile and market position relate to the company's competitive position, i.e., is it a top player in the industry or another start-up trying to compete with the top dogs. For example, is it more like an Apple (AAPL) with 46% market share of the cell phone market in the US, or a brand that has, say, 5% market share?

Another important issue under this heading is the competitive condition of the primary industry of the firm, i.e., whether the industry is fragmented with many companies operating in it, with no real market leader, or if it is a concentrated industry with few players holding the majority of market share.

Stability and growth rates of revenue are important considerations here as well, i.e., is revenue stable with a stable or exponential growth rate, or whether there is a sporadic variation in revenue, such as one year the firm clearing $200,000 in net income, but $35,000 in the next year. The stability of net income translates to the stability of cash flow; a volatile cash flow increases the risk of default on obligatory payments.

Similarly, product and geographic diversity are pertinent here; does the firm have a few products with high segment competition and emerging competition? Are the sales primarily based on one geographical region, or whether the firm has a diverse variety of stable and growing products (revenue-wise), and has stable sales in a variety of geographical locations, thus lower risk of failure through the failure of a few products or economic distress in a few main regions.

Leverage and Liabilities, and financial strength relate to the overall viability and financial condition of the firm. For example, what is the debt to equity and debt to asset ratio of the firm, what is the available interest coverage, what is the applicable interest rate of the firm, and how these ratios compare with the industry averages, what is the growth rate of the firm's liabilities, what is the inventory turnover ratio, what is the days sales outstanding (DSO), retained cash flow/net debt? If the firm is a start-up, what is the cash burn rate? Are net profits persistently higher than net cash flow, etcetera?

The firm's ability to tolerate adverse events is also important here; for example, does the firm have enough cash and short-term liquid assets to prevail in a negative environment, or is it already at the very precipice of life and death? Last but not least, the capital structure of the firm is also worth analyzing. For a smaller firm, it is also essential to assess if the firm is an insider-corporate governance system, i.e., are a majority of shareholders, managers, and directors in the firm? It's not that all insider corporate governance structures are inadequate, but due to insider structures, information asymmetries may arise that, of course, are not ideal. These parameters would help scrutinize the financial health of the business.

Idiosyncratic risks are risks that the firm may be exposed to that aren't systemic in nature, but may specifically arise in the subject company. These risks may impact the company negatively (downside risk) or positively (upside risk), and their impact may be significant. For example, the firm may be under litigation, and a negative verdict may be highly likely, or there may be rumors, with reasonable merit, regarding directorial or managerial wrongdoings that impact the firm severely.

Alternatively, positive risks may also be likely, i.e., it may be very likely that the firm may gain approval for a drug it has been testing, or a major construction project may be awarded. For smaller businesses, a positive risk may relate to being mentioned in an authority magazine, receiving a 'shoutout,' as they say, from a celebrity, or winning a design award or approval of patent, etcetera.

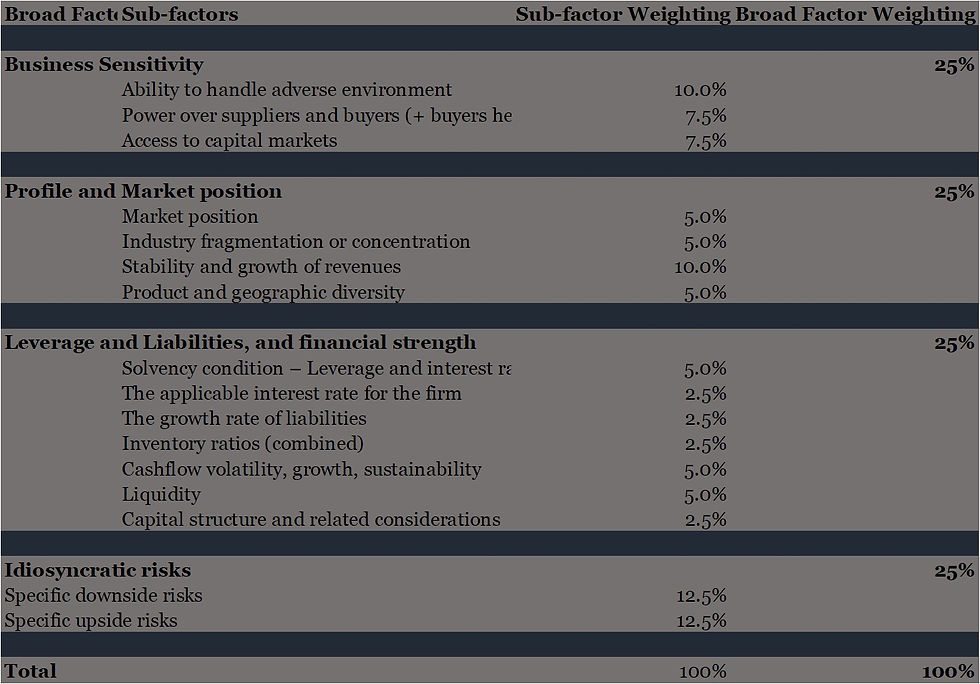

Calculation of Quantifiable Rating Factors

For this assessment, we must allocate overall weights for each of the four areas mentioned above and sub weights for the factors that make up the broader area.

Ideal weights that may be broadly applied:

1.

Business Sensitivity

Broder weight – 25%

Sub weights:

Ability to handle adverse environment 10%

Power over suppliers and buyers (+ buyers health) 7.5%

Access to capital markets 7.5%

2.

Profile and Market position

Broder weight – 25%

Sub weights:

Market position 5%

Industry fragmentation or concentration 5%

Stability and growth of revenues 10%

Product and geographic diversity 5%

3,

Leverage and Liabilities, and financial strength

Broder weight – 25%

Sub weights:

Solvency condition – Leverage and interest ratios (combined) 5%

The applicable interest rate for the firm 2.5%

The growth rate of liabilities 2.5%

Inventory ratios (combined) 2.5%

Cashflow volatility, growth, sustainability 5%

Liquidity 5%

Capital structure and related considerations 2.5%

4.

Idiosyncratic risks

Broder weight – 25%

Sub weights:

Specific downside risks 12.5%

Specific upside risks 12.5%

Practical example|how to apply this model

This section provides a practical example for the model elaborated in this technical report.

Let's assume we want to evaluate a business to determine whether it is worth investing in and if it would survive or perish. These are questions that are regularly investigated by investors, venture capitalists, angel investors, etcetera.

We would investigate the 4 areas elaborated above:

Profile and Market position

For business sensitivity, we would first examine the ability to handle the adverse environment. To do so, we would need to determine the linear relationship of the products sold by the business with the GDP of the country, or countries the firm operates in (proportionally subdividing sales to specific countries and the specific quarterly GDP to determine the linear relationship(s)).

For example, let's assume the business sells 1 product in 2 countries, US and Canada, equally; the covariance (Beta) of sales of product 1 with the US GDP is 1.5, with the same figure standing at 1.6 for Canada. We would thus know that if a recession struck both countries simultaneously, assuming an equal level of GDP downside of, say, -3%, the firm's sales would decline by 1.55 (the average covariance of the two markets = 1.5+1.6/2 = 1.55) × the decline of GDP of -3 = 4.65 ( -3 × 1.55).

This number may be evaluated against the industry the firm is in or the alternative investment opportunity that may be present. More practically, this figure may be calculated against the top company in the industry or the top few companies to gauge the ability of the firm to survive in an economic downturn. After this data analysis, judgment must be used to examine the relative strength of the company's revenues ( very much the oxygen for business survivability) to give it a relative score from 1 to 10. If, say, a score of 7 out of 10 is given to the business, this would mean that under the sub weight of "ability to handle adverse environment (10%)," the firm is given a score of 7%.

It is also important to note that not everyone may be familiar with linear regression or may not have the time to use regression in this model; in that case, judgment may be used for the whole exercise for allocating weights; nonetheless, data-based models would always yield more accurate results.

We must examine the firm's suppliers, supply chain, and buyers for the second sub weight, power over suppliers and buyers, under the first heading. Is the business dependent on one or a few suppliers? Are the suppliers dependent on resources that may be rare or potentially disrupted, such as rare minerals or bottlenecked resources? Also relevant here is the strategic risk posed by being dependent on a few suppliers; if the firm is reliant on a few businesses, if those businesses change the rates they charge or change the quantity they supply, etcetera, the firm would be unable to operate at a constant volume until it resolves the issues or finds new suppliers.

Risks associated with the supply chain are also important; even if the firm has multiple suppliers, if the suppliers are all based in countries with risks such as high political instability, probable climate-related disruption, and so on, the supply chain wouldn't be safe. A supply shortage may occur, paralyzing operations.

Similarly, the strategic reliance on one or a few buyers and the weakening position of the buyer would need to be analyzed here. If the firm is reliant on one buyer, the buyer may reduce the prices it pays the firm, and without an alternative, the firm may have to oblige.

Under this sub weight, the analyst would need to give the firm a score from 1 to 10 depending on the factors discussed. If the firm has multiple suppliers in multiple stable locations and a safe, stable supply chain with low risk of disruption, and various buyers/channels of supply and distribution, the firm's score would be high, say 9/10, and that would translate to a score of 6.75 (7.5 × .9) under this sub weight. Alternatively, if all the negative factors are present, the score would be a 1/10, and a 0.75 (7.5 × .1) for the sub weight.

Access to capital markets must be measured next; if the company is listed and has no auditor objections against its financial statements in the last, say, 10 years, and the firm has previously raised debt finance at a reasonable rate of interest, and its bonds have maintained a high rating in the market of at least BBB, and above, the firm would score high under this domain: 6.75 (7.5 × .9). Alternatively, a small firm whose stock isn't traded publically, and would pay a hefty interest rate for borrowings, if need be, would score poorly 0.75 (7.5 × .1).

Profile and Market position

The first factor to consider under this weight is the market position of the firm in the industries it operates in; if it is a top-five firm in a growing market, it gets a high score, 4.5 (5 × .9). Oppositely, a firm that has less than 1% market share should be allocated a score of 0.

Industry fragmentation or concentration is the second sub weight here. The structure of the industry the firm operates in and the firm's growth rate is the subject of analysis under this subheading. If a firm is a newcomer in a concentrated industry, without substantial improvements to the operational business model, and has a low growth rate, the firm would score low here: 0.5 (5 × .1). Alternatively, a firm with an impressive growth rate, say, 30% p.a. for the last three years in a fragmented industry, would earn a high score of 4.5 (5 × .9).

The stability and growth rate of revenues is the next important issue under this heading. Is the firm's revenue/income stable? Is the growth of the revenue exponential? If the answers to these questions are yes, a high score should be allocated here 9 (10 × .9). However, if the firm has sporadic variation in revenues and the growth rate is negative or mediocre, varying from year to year, i.e., positive one year and negative in the next year, the firm would be allocated a low rating of 1 (10 × .1).

Product and geographic diversity is the last sub weight in this heading. For example, does the business have just 1 product that it sells in 1 location? If this is the case, a score of 0 would be allocated; if the firm has multiple successful products and product categories that it sells in multiple countries, then a high score would be allocated here: 4.5 (5 × .9).

Leverage and Liabilities, and financial strength

Solvency condition – Leverage and interest ratios are the first important issue under this heading. Here we must assess the debt to equity ratio & debt to asset ratio of the firm; secondly, the interest coverage, i.e., the total required interest payment / EBIT, must be calculated. If these figures for the business match well with industry averages, the firm should be allocated a decent score of 4.5 (5 × .9); nonetheless, if the interest coverage is precariously low and the leverage ratios are higher than that of the competitors or the industry, a low score must be given: 0.5 (5 × .1).

The applicable interest rate for the firm is the second issue under this weight. The total interest outlay in the year must be divided against the long-term debt of the firm. If the company's income statement reports an annual interest outlay of $10 and the total long-term debt is $100, the applicable rate would be 10%. This rate should be assessed against the applicable rate paid by the competitors. If the rate the firm pays is higher than the firm's competitors, it should get a low score; if the rate is very much comparable with the rate paid by the competitors and the primary industry at large, then the firm would get a high score of 2.25 ( 2.5 × .9).

The growth rate of liabilities is the third issue under this heading; if the borrowings of the business have steadily been growing in the last 5-10 years, and if the debt to assets ratio is already higher than the industry average and the competitors, then the firm would be allocated a low score 0.25 ( 2.5 × .1). On the other hand, if the debt hasn't been rising in a volatile manner and is at optimal levels for an efficient capital structure, then the firm must be allocated a high score: 2.25 ( 2.5 × .9).

The third issue under the current heading is Inventory ratios. The objective here is to examine how efficient the company is in selling the inventory it buys, the time it takes to sell, etcetera. For example, the days it takes to sell inventories, the time it takes to collect money from the time of sale, as calculated days sales outstanding (DSO), the cash conversion cycle, and how often inventories cycle through the system must be assessed. This figure must be compared with competitors. If the firm sells more inventory and has a shorter DSO, and the inventory cycle rate is efficient, the firm must be allocated a high score: 2.25 ( 2.5 × .9); if this is not the case, a low score of 0.25 ( 2.5 × .1) would be given.

The fourth sub weight under this heading is Cash flow volatility, growth, and sustainability. Here my must examine the stability of cash flows, their growth, and sustainability. Are cash flows persistent with a stable growth rate in the last, say, 5 years? Are the revenues derived from quality maintainable sources, thus, resulting in sustainable cash flow? Is the cash flow persistently higher than net income? If the answer to these questions is yes, the company should be allocated a high score of 4.5 (5 × .9); if the answer to these questions is no, then a low score of 0.5 (5 × .1) must be given.

Liquidity is the fifth issue under this heading; this is an analysis of liquidity ratios against the industry average or the same for competitors. The current ratio, which is calculated as current assets/current liabilities, and the quick ratio (current assets – inventories/current liabilities) are the two important liquidity ratios.

These ratios should be calculated for the company and compared with competitors and industry averages. Also worth analyzing is whether the firm has enough cash to prevail in a negative economic environment. If the firm has a liquidity position comparable to peers, and it has the cash to weather out an economic downturn, then it should be allocated a high score of 4.5 (5 × .9), a low score of 0.5 (5 × .1) would be allocated if the answer to this question is no.

The last weight under this heading is capital structure and related considerations. We must examine whether the firm's capital structure elements, debt, equity, and other instruments such as preferred stock are at a comparable level with the industry and top competitors. For example, is the debt level optimal considering the industry at large? If it is so, a high score of 2.25 ( 2.5 × .9) must be given; otherwise, depending upon the condition, a low score of 0.25 ( 2.5 × .1) would be given.

Idiosyncratic risks

The two sub weights under this heading are the specific adverse risks and specific positive risks. For the downside risks, the analyst must assess all business-specific risks and their probabilities (as explained in the idiosyncratic risks section above). If there are severe risks that are probable, risks that may disrupt all operations of the company, or risks that most likely would result in the business going bankrupt, then regardless of the other factors, the analyst should rate the companies survivability negatively.

If the adverse risks a severe but not 'life-threatening,' a negative score would be given 1.25(12 × .1). Alternatively, if there is a high probability of positive risks, such as an approval of a major drug, a lucrative construction contract, etcetera, then a positive score of 11.25(12 × .9) must be allocated.

Compiling all figures and formulating final verdict

Finally, after all scores have been allocated, after an in-depth analysis, the scores must be compiled for the final assessment.

A theoretical best case and worst case is illustrated below in figure 2 and 3:

Of course, in a practical, real-world scenario, all factors wouldn't have a good or a bad score, and the score per factor would be mixed. As a rule of thumb, if the result is above 60% overall, the subject business should be classified as having moderate staying power, the business should survive long-term, and the model provides an approximate probability of survival of 60%.

Above an overall score of 75%, the business in question should be classified as strong; such firms would be in good health, and their long-term survivability may not be a concern. Businesses with an overall score of 45% and under may be in danger of bankruptcy and should be assigned a rating of low staying power; the majority of such businesses should struggle to survive long-term.

Contact us for ordering a business analysis by a chartered professional!

_edited.png)

Comments